AUSTIN, Texas – The Austin Board of REALTORS® (ABoR) February 2020 market analysis showed a 6.8% increase in residential home sales in the Austin-Round Rock Metropolitan Statistical Area (MSA) and a 12.8% increase in median sales price to $327,140. While sales increased from 2,363 homes in February 2019 to 2,524 homes last month, new listings decreased 11.8% year-over-year, and inventory dropped to 1.5 months of inventory, painting the picture of Austin's historically competitive housing market and high demand. With the impact of COVID-19 beginning to take hold, it's uncertain how social distancing will affect the way the market continues to operate.

“Historically low interest rates are a driver in the market response we saw in February and will continue to act as a driver despite our shared concerns over the impact of COVID-19 in our community,” Romeo Manzanilla, 2020 ABoR president, said.

Manzanilla said there are a number of tools and best practices that ensure REALTORS® can continue to serve Central Texas home buyers and sellers safely as we all make changes to accommodate the Center for Disease Control’s guidelines.

“REALTORS® will work to provide a new homebuying and selling experience in these times. Expanded visual libraries, interactive floor plans and virtual tours are tools that matter more than ever in this climate. The housing market is absolutely still open for business, but the business of real estate is evolving like we all are through this experience,” Manzanilla concluded.

Austin’s economy and housing market could be well positioned to minimize the potentially negative impact of COVID-19, Mark Sprague, state director of information capital for Independence Title, said.

“Austin’s economy has diversified and strengthened over the past two decades. This leads me to be optimistic that our region is in a strong position to withstand economic downturns that may have a greater impact nationally,” Sprague said. “Effects will still be felt, especially by those who depend on each paycheck to pay their bills and provide for their families, and that cannot be discounted.”

According to Sprague, despite the current uncertainty, buyers are still eager to close sales in Austin.

“Current indicators are that Austin’s housing market remains strong and competitive. Any decrease in inventory would only increase competitiveness in our market. Overall, Austin’s economy and housing market look to be resilient during this uncertain time. Once COVID-19 subsides, there is a potential for even more investment by employers in the Austin market, and I would expect those looking for a more affordable cost of living compared to other major U.S. metropolitan areas will still look to move to and buy homes in Austin,” he concluded.

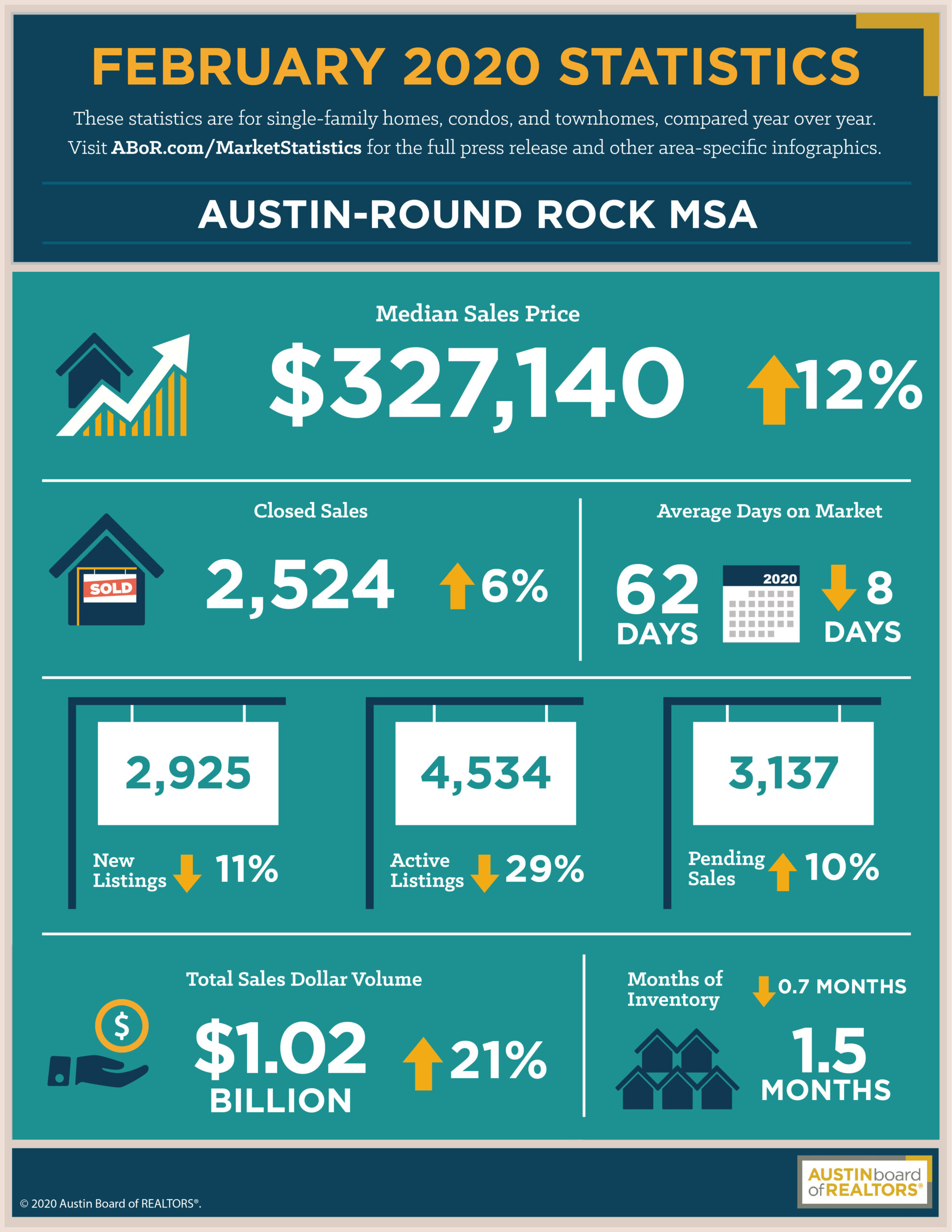

Austin-Round Rock MSA

In the Austin-Round Rock MSA, the median sales price for February 2020 was $327,140, an increase of 12.8% from February 2019. February residential home sales dollar volume increased 21% to $1,027,245,686. During the same period, new listings decreased 11.8% to 2,925 listings, and active listings decreased 29.4% to 4,534 listings. However, pending sales jumped 10.9% to 3,137 pending sales. Monthly housing inventory declined 0.7 months year over year to 1.5 months of inventory. Across the five-county MSA there were 2,524 closed sales.

City of Austin

High demand across the city and limited inventory pushed the median price for residential homes to $395,000, a 14% increase from February 2019. Residential home sales increased 3.3% to 857 sales and total sales dollar volume increased by 18.1% year over year to $417,071,623 last month. During the same period, new listings decreased 5.6% to 1,032 listings; active listings dropped 34% to 1,072 listings; however, pending sales rose 4.5% to 999 pending sales. Monthly housing inventory decreased 0.6 months year over year to 1.0 month of inventory.

Travis County

At the county level, residential home sales increased 8.8% to 1,301 sales and sales dollar volume increased by 22% to $613,634,673. The median price for residential homes increased 13.2% year over year to $376,500. During the same period, new listings decreased 13.6% to 1,550 listings, while active listings decreased 35% to 2,022 listings. However, pending sales increased 9.4% to 1,615 pending sales. Monthly housing inventory decreased 0.7 months year over year to 1.3 months of inventory.

Williamson County

In Williamson County, February residential home sales increased 4.7% to 851 sales; sales dollar volume experienced a double-digit increase of 13.3% to $277,257,487. The median price for residential homes increased by 6.8% to $293,600. New listings declined 16.9% to 863 listings, while active listings decreased 33.7% to 1,398 listings. Pending sales increased 7.1% to 991 pending sales and housing inventory declined 0.9 months year over year to 1.4 months of inventory.

Hays County

In February, Hays County residential home sales increased 3.9% to 270 sales and sales dollar volume jumped 37.6% to $110,763,712. The median price for residential homes increased by 9.6% to $285,000. During the same period, new listings decreased 4.4% to 351 listings and active listings dropped 17.6% to 700 listings. Pending sales spiked 23.7% to 397 pending sales. Housing inventory decreased 0.7 months to 2.1 months of inventory.

Bastrop County

In Bastrop County, residential home sales remained flat at 77 home sales, while sales dollar volume increased 13.7% to $20,306,295. The median price for residential homes slightly increased 3.7% to $239,950. During the same period, new listings spiked 27.8% to 124 listings; active listings rose 16.1% to 324 listings; and pending sales jumped 20.7% to 105 pending sales. Housing inventory decreased 0.1 months to 3.3 months of inventory.

Caldwell County

In Caldwell County, February residential home sales spiked 47.1% to 25 sales, and sales dollar volume jumped 40.4% to $5,379,315. The median home price decreased 9.6% year over year to $201,000. During the same period, new listings spiked 85% to 37 listings; active listings increased 18.4% to 90 listings; and pending sales rose by 38.1% to 29 pending sales. Housing inventory rose 0.3 months to 3.5 months of inventory.

For more information, and to download the February 202